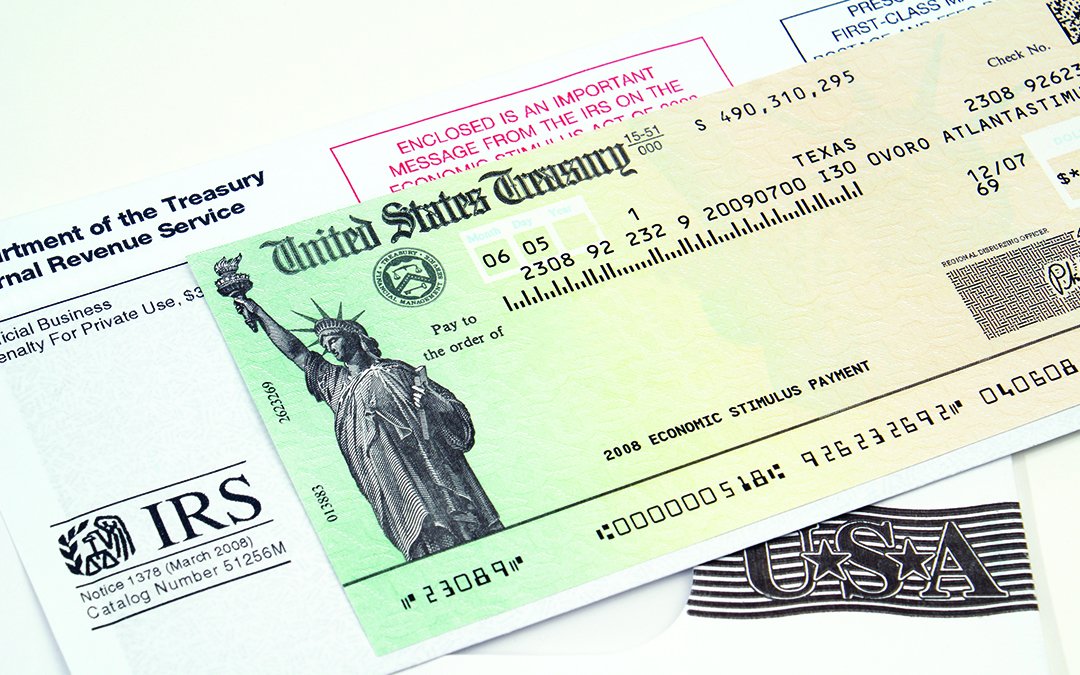

A tax refund is a payment made to a taxpayer for any excess amount paid to the federal or state governments. While most taxpayers regard a refund as a windfall or a stroke of luck, it frequently reflects what amounts to an interest-free loan paid to the government by the taxpayer. It is frequently feasible to avoid overpaying your taxes, allowing you to keep more money in your pocket with each paycheck—and prevent a refund when you submit your tax return.

Reasons Why a Taxpayer Might Get a Refund

The taxpayer made a mistake when completing Internal Revenue Service (IRS) Form W-4, which is used to estimate the right amount of withholding from an employee’s paycheck.

The taxpayer fills up their W-4 on purpose to receive a greater withholding and a larger tax refund at tax time.

The taxpayer failed to amend their W-4 to reflect a change in circumstances, such as the birth of a kid, resulting in an extra Child Tax Credit. A self-employed or freelancer who files quarterly estimated taxes may overpay to avoid a surprise tax bill or underpayment penalties at tax time.

The taxpayer is entitled to refundable tax credits, which can lower the amount of taxes payable to zero, even if no tax is owed otherwise. If the credit exceeds your tax bill, you will be refunded the difference. If the credit exceeds your tax bill, you will be refunded the difference.

Get a Bigger Tax Refund

According to the Internal Revenue Service, the average 2020 tax refund was $2,546 as of Dec. 3. According to the IRS, more than 125 million refunds were provided out of the more than 163 million returns processed.

Ameriprise Financial’s Betsy L. Billard, a private financial advisor, says there are a few levers clients may pull to lower their tax burden and earn a greater return if that is their aim. “Everyone enjoys the feeling of getting a refund,” she explains. When you contact a CPA, they may advise you to change your withholding since that money should be in your possession to save throughout the year rather than giving the government a free loan. You can deposit as much money into a 401(k) or 403(b) as you can, which will assist decrease your taxes.

Other methods include reporting dependents correctly, deducting charitable contributions, and researching lesser-known credits.

Where’s My Tax Refund?

According to the IRS, taxpayers should get their refund within 21 days of submitting their tax return. Create or log in to your IRS online account to track the status of your refund.

Your refund may be delayed due to a variety of factors, including problems with the processing of your return. Sign up for a direct deposit and double-check your return for any possible problems that may drag down the procedure to receive your refund as soon as possible.

Tax Refund Delay

Assuming you file online with direct deposit into your bank account, you should get your refund within 21 days if your return is error-free. If you file electronically but want a physical check, you should expect to get your refund within a month.

If you file a paper return or if the information in your return does not pass through the IRS’ electronic filters – for example, if the income you reported does not match up with the W-2s or 1099s the IRS received for you, or if there are errors on your return – that time frame can be significantly extended.

Your refund may be delayed this year if your tax return from last year is still stuck in the IRS backlog. You can’t clear this year’s tax return until the preceding year’s tax return is cleared, and you have no idea where you are in the pile. You might face a lengthy wait for a simple.

Check the Status of Your Refund

You may check the status of your return within 24 hours after e-filing by using the IRS’s Where’s My Refund? service. If you submitted a paper return, you may not be able to check on its progress for four weeks or more. Input your Social Security number, filing status, and the precise dollar amount of your tax refund. The tool will notify you whether your return was accepted if the refund was approved and if the money was issued. The IRS updates the data daily.

State Income Tax vs. Federal Income Tax

State income taxes might vary greatly from one state to the next. The majority of states either have a flat or progressive income tax system. A flat tax system (also known as a single-rate structure) has a single tax rate applied to all income levels. Colorado (4.55 percent), Illinois (4.95 percent), Indiana (3.23 percent), Kentucky (5 percent), Massachusetts (5 percent), Michigan (4.25 percent), North Carolina (5.25 percent), Pennsylvania (3.07 percent), and Utah are among the nine states that employ this technique (4.95 percent ). 2

Greater income levels are taxed at a higher percentage rate in states that implement progressive tax systems. This system is utilized in the federal income tax system. Some jurisdictions base their marginal tax brackets on the federal tax code for this purpose, while many states create their own.

Hawaii has twelve tax brackets, whereas Kansas and six other states only have three. California has the highest top tax rate of 13.3 percent, which applies to persons with taxable incomes above $1 million and married couples with incomes exceeding $1,198,024. North Dakota has the lowest top marginal tax rate, at 2.9 percent for people and married couples earning more than $440,600.

Some states have no or minimal income tax. Residents in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not pay income taxes.

With the adoption of the Tax Cuts and Jobs Act in 2018, the United States’ Internal Revenue Code (IRC), which governs federal income taxes, received substantial modifications (TCJA). At the federal level, there are presently seven marginal tax brackets: 10%, 12%, 22%, 25%, 32%, 35%, and 37%.

For the 2021 tax year, the highest rate of 37 percent applies to taxable income of $523,600 for singles and $628,300 for married couples filing jointly.

For the 2022 tax year, the maximum rate of 37% applies to singles earning $539,900 and married couples earning $647,850.

In recent years, the IRS has faced various obstacles, including difficulty finding staff to process returns, making significant tax law changes, and, most recently, managing the 2020 and 2021 filing seasons amid the pandemic. As a result of these difficulties, taxpayers found it difficult to obtain assistance via the IRS’s other customer service channels, such as hotlines and written communications. Taxpayers experienced increased wait times and other delays, owing in part to the number of phone calls and mail received by the IRS.

More to read:

What are the Ways to Pay Off the Student Loans Fast?

Best Cashback Credit Cards You Should Own