You are familiar with swipe and spend but how often do you get swipe, spend and save- all together. Well, you can with cashback credit cards. Rewards on credit cards are quite popular these days. And nothing beats cash as a reward. Whether you spend it on other purchases or just save it, these cashback credit cards are quite in vogue.

Cashback credit cards give a certain percentage of your purchase as a reward. However, what matters is your spending habits! Also, cashback credit card offers to vary a lot. While some cards offer 1% to 2%, other credit cards give slightly more than 2%.

So, let’s take a look at the best cashback credit cards that you must try once. And of course, save a dime every time you shop.

- Chase Freedom Unlimited

If you wish to save on every type of purchase, from booking tickets to drugstores spending, Chase Freedom Unlimited is your go-to credit card. Sign up with an introductory offer of earning an extra 1.5% cashback on every purchase up to $20,000 in the first year. Well, this can be worth up to $300 of cashback. And, it’s quite a big amount when it comes to cash-backs.

Besides, Chase Freedom Unlimited covers multiple categories including 5% on travel, 3% on dining, 3% on drugstores, and 1.5% for rest types of purchases. We also liked its Annual Percentage Rate of 15.24% to 23.99%. Above all, the Chase Freedom Unlimited credit card doesn’t have an annual fee. Sign up for this, if you need the best of all cash back credit cards.

- Bank of America Customized Cash Reward Credit Card

The craze for online shopping is immense. We’re sure your smartphones definitely have a few online shopping apps. Of course, who wouldn’t prefer online shopping – it’s convenient and rewards/discounts are also plenty. And, to increase your savings a little more, we suggest you Bank of America Customized Cash Reward Credit Card.

With an introductory offer of $200 online cash rewards, this cashback credit card is just perfect for online shoppers. Besides, this $200 cash reward can be availed on a minimum purchase of $1000 within 90 days of opening the account. Other rewards rates are 3% cashback on categories of your choice and purchases up to $2500. At grocery stores and wholesale clubs, this card can avail you of 2% automatic cashback. And, for all other purchases, you get an unlimited 1%. Of all these rewards, we love this card’s welcome bonus of 0% APR for 15 billing cycles.

So, if you’re into some serious cash crunch, you can always avail some additional savings through this Bank of America Customized Cash Reward Credit Card. Also, note that you have to select online shopping manually via your internet/mobile banking to avail the rewards.

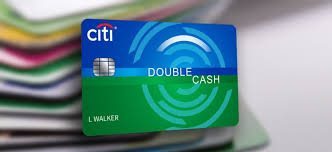

- Citi Double Cash Card

Varying the amount of cashback from credit cards is often confusing. We know rotating reward categories are at times worrisome. Nevertheless, you’ve got a great credit card option- Citi Double Cash Card. It’s really simple; you earn 1% on your purchases and 1% on your bill payments. And, without a penny charged for an annual fee, this cashback credit card definitely has a universal appeal.

Another interesting thing about this card is you get a waiver on your first late fee. Despite this, we believe it’s always better to pay off the amount on time to avoid paying extra. Besides, Citi Double Cash Card offers 0% APR to users for the first 18 months on balance transfers. But it doesn’t have any welcome bonuses.

So, if you’re some serious saver, then Citi Double Cash Card is your card. We also love its special card members programs like the Citi Entertainment card for easy access to booking tickets, and Citi Identity Theft Solutions in case of stealing.

You’ll get plenty of options when it comes to cashback credit cards. However, which one to choose depends a lot on your expenses and the kind of rewards you wish for. Since there are flat-tier, rotating and many more types, we feel it’s always best to decide first and then apply for one. And on that note, we hope these 3 cashback credit cards are definitely the top picks of many.

Apply for your cashback credit card so that every time you spent a lot, you’ll relax thinking of your cashback rewards. And, this is definitely one of the coolest ways to fill up your piggy bank!

More to read:

Best Stores For Couponing 2022- Save More and Shop More

Best Buy Open Box: What’s In It For You?

Best 6 Freebies Websites For Getting Free Stuff Online